Move over sf86 there is a new security clearance application form coming to town hi my name is Lindy Kaiser with clearancejobs.com and a Federal Register notice that was put out last week they announced a new Personnel vetting questionnaire or pvq that will eventually replace the three forms currently used in the security clearance eligibility vetting process the sf85 sf85p and the much beloved sf-86 some tweaks and changes to the Forum that were announced in that Federal Register notice the reason it's included there is that there is a time for comment so agencies folks who have a vested interest in this process and who have feedback on that form can check out that Federal Register notice and provide their feedback for the average applicant or person kind of investigating the security clearance process for themselves right now or who has a security clearance there's really nothing you need to do with this information other than if you're a geek like me and you just really really care about it you can follow what will be probably some more updates coming out in the next few weeks in regards to what's included on the form why the government the Security executive agent or the office of personnel management is announcing and pushing out these changes to the Forum it's really a part of the holistic Trust of Workforce 2.0 process trying to update enhance re-evaluate how the government establishes trustworthiness so you'll see within that a few changes to the form kind of eliminating some of the questions around gender that are not investigatively relevant to the process eliminating questions in general that are just no longer relevant I heard hair colors out which if you watch these updates you know mine changes every week so that makes...

Award-winning PDF software

How to prepare Form SF-86

About Form SF-86

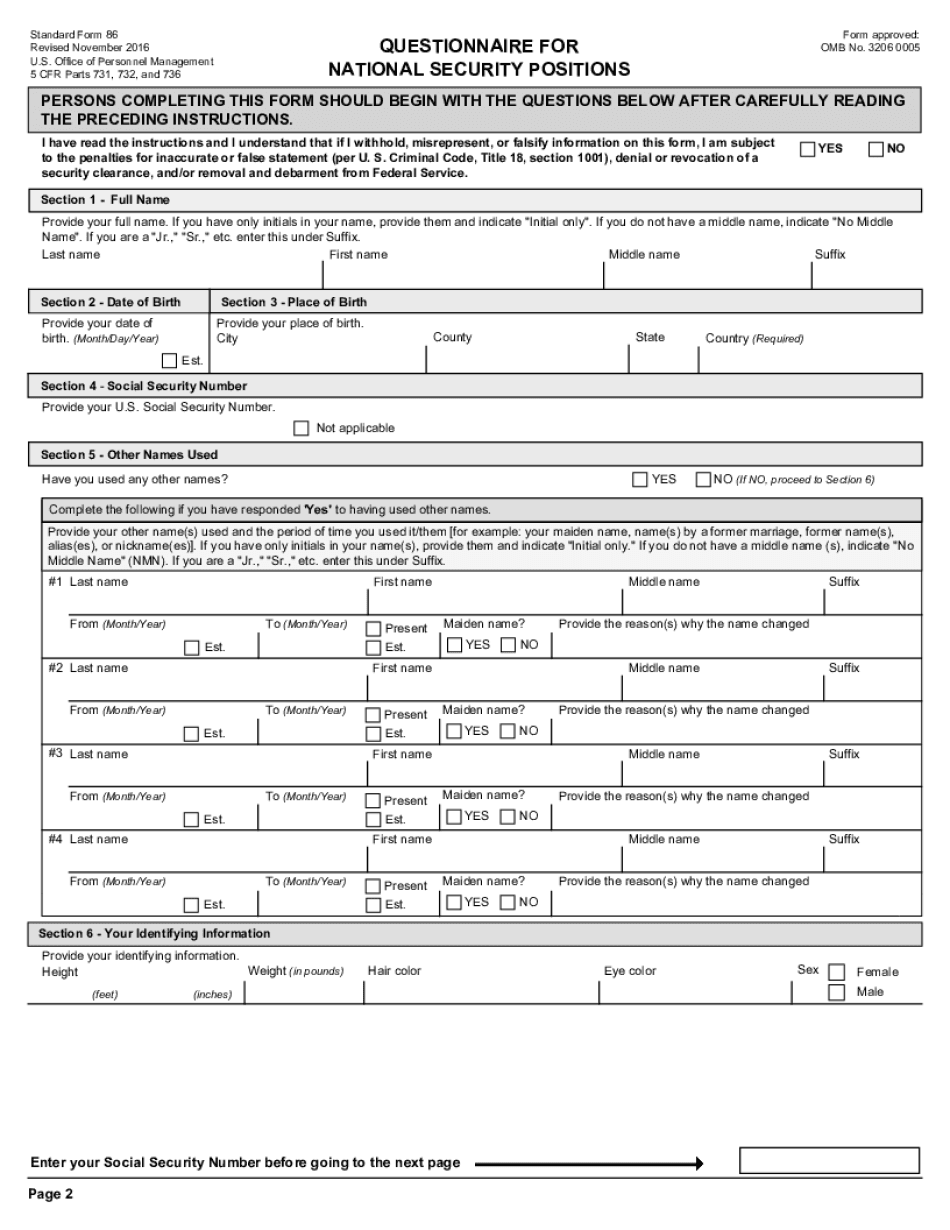

Form SF-86, also known as the Questionnaire for National Security Positions, is a document used by the United States federal government to conduct background checks on individuals seeking access to classified information or holding a position of trust within the government. It is primarily used for security clearance determinations. The form collects detailed information about an individual's personal, financial, and employment history, as well as their references and contacts. It requires applicants to disclose various aspects of their life, including criminal records, drug use, mental health history, foreign contacts, and travel outside of the United States. Form SF-86 is needed by individuals who are applying for or already hold positions that require access to classified information or involve national security. This typically includes military personnel, federal employees, contractors, and employees of private companies that work on government contracts involving sensitive information. These positions can range from jobs in intelligence agencies, defense contractors, law enforcement agencies, or any role that requires handling or accessing national security information. The information provided through Form SF-86 is used to conduct thorough background investigations, evaluate an applicant's suitability for a security clearance, and determine their eligibility to access classified information or occupy a position with national security implications. It is crucial for ensuring the security and integrity of sensitive government information and protecting national interests.

What Is Sf86?

Form SF-86 is a Questionnaire for National Security Position. It is usually completed by members of armed forces, government contractors and employees in order to apply for Security Clearance.

It is also intended for conducting investigations and reinvestigation of persons under advisement to national security positions.

An approved form further will praccess to the classified information such as state and organizational secrets as well as to limited areas.

In some cases a person may be asked by an investigator to come for an interview in order to explain some answers provided in a form. While being interviewed, a person may clarify, explain or update some data that will assist in completing an investigation.

We offer you to fill out an updated editable Sf 86 Form sample in PDF that can be prepared online just in a few minutes.

It is possible to customize a document in compliance with your requirements using our various editing tools and make it neat. Follow the specified instructions and complete a document correctly.

A blank SF-86 form includes 29 sections which have to contain the next details:

- personal information (i.e. full name, date and place of birth, passport details etc.);

- citizenship;

- residence information;

- information about education;

- employment activities;

- military history;

- marital status;

- foreign contacts and activities;

- psychological and emotional health;

- police records;

- financial and association record.

In order to avoid any rejections or delays it is necessary to check if all data provided is true and sufficient. Don't forget to enter your social security number at the bottom of a document.

Put a signature and date of preparing in a final document. You may easily sign a document with the help of our service of electronic signature. If required, a document can be exported from PDF to other needed formats.

Online choices help you to organize your doc management and increase the efficiency of the workflow. Follow the fast guide for you to finish Form SF-86, steer clear of glitches and furnish it in a well timed way:

How to finish a Sf 86 Form?

- On the website while using the variety, click on Launch Now and pass to the editor.

- Use the clues to complete the relevant fields.

- Include your individual knowledge and speak to facts.

- Make sure that you just enter correct details and numbers in correct fields.

- Carefully check the content within the type in the process as grammar and spelling.

- Refer that can help portion in case you have any problems or handle our Aid group.

- Put an digital signature on your Form SF-86 using the aid of Sign Software.

- Once the shape is completed, press Accomplished.

- Distribute the prepared variety through e-mail or fax, print it out or help you save on your unit.

PDF editor enables you to definitely make changes to the Form SF-86 from any world-wide-web related device, customize it based on your preferences, indicator it electronically and distribute in various approaches.

What people say about us

Video instructions and help with filling out and completing Form SF-86